The Main Principles Of Paul B Insurance

Wiki Article

The Paul B Insurance Statements

Table of ContentsThe Paul B Insurance Ideas10 Easy Facts About Paul B Insurance DescribedGetting My Paul B Insurance To WorkMore About Paul B Insurance

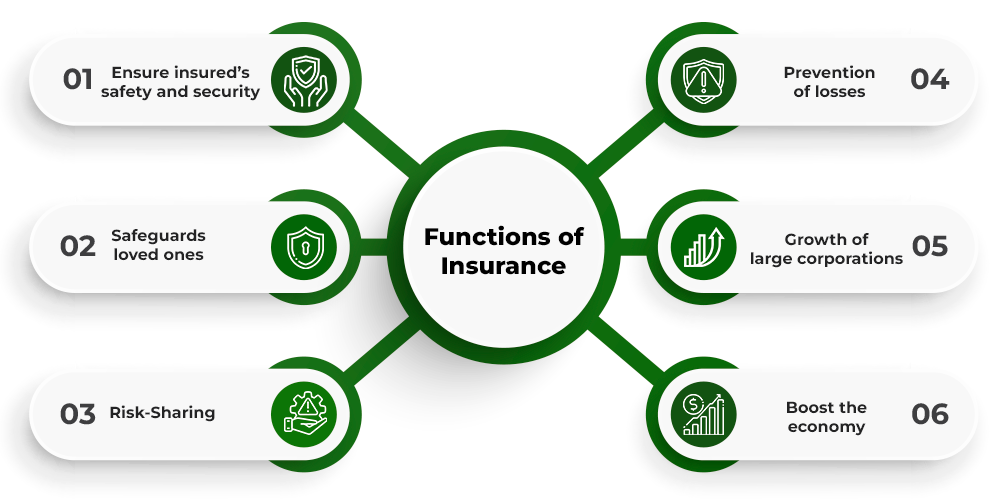

Your employees don't just value themselves, however also their loved ones. Accidents happen and also in one of the most unexpected times, as well. One value of insurance as a staff member advantage is that it supplies protection to your workers, as well as their families. That when crashes do happen, they are extra prepared.Therefore, increasing their efficiency. Delighted as well as pleased employees also have far better as well as stronger relationships at the workplace. Insurance coverage is one of the generally provided fringe benefit that are not discussed. A lot of employers provide them yet don't take into consideration or forget their great value. Not just with the employees, however to the company.

How, you ask? Consumers have come to be so accustomed to regular that they typically don't understand the battery of danger and unpredictability they face everyday. Whether it's a vehicle crash, an unintended residence fire, a swamped cellar from a large tornado, or an injury at the workplace, unexpected difficulties can show up anytime.

When catastrophe strikes, an insurance policy strategy can offer consumers with the financial help they need. Without it, several individuals in these scenarios would be financially stressed and can even deal with bankruptcy. As with consumers, aiding businesses mitigate danger can have a long lasting, favorable influence on the economic climate. A stronger Key Street results in stronger areas and also total improved financial health of individual states and also the country in its entirety.

What Does Paul B Insurance Do?

When catastrophe does strike, insurance policy is among the most effective economic devices companies can call upon to assist tackle these challenges. Organization insurance policy additionally assists drive growth. At its core, the protective security web of insurance enables businesses to undertake higher-risk, higher-return activities than they would in the lack of insurance.According to the American Insurance coverage Association, property-casualty insurance providers operating in the U.S. have greater than $1. 4 trillion bought the economy. Insurance provider generally invest premiums, or dollars, that are not made use of to pay insurance claims as well as various other business expenses. With supply, company as well as government bonds, and also property home loans, these financial investments usually finance structure construction as well as give various other important assistance to economic development projects around the country.

Running an organization features fundamental risks: A staff member might get wounded at work; a natural catastrophe might destroy property; or a client can file suit, declaring a legal violation. For those and also various other reasons, it see this here is essential to safeguard your possessions, both organization and personal. One of the most effective ways to do that is to make certain you as well as your business are effectively guaranteed.

Paul B Insurance Things To Know Before You Buy

Here's a reason you may not have actually thought of: Having insurance policy makes your company appearance reputable. Company insurance policy shows your prospective clients as well as customers that you're a safe bet.

Your most important asset is not the product and services you provide, the tools you take a lot like maintain or perhaps the brand name you struggled for several years to construct. No, your most valuable property is your staff members, and also it pays to safeguard them in case of a crash.

For that reason alone, it's ideal to be insured. With the correct company insurance coverage, local business owners can achieve assurance as well as focus their interest on what they do finest operating an effective, rewarding as well as directly rewarding service for years to come.Insurance Photousing Shutterstock, Much More in: Insurance policy. Does words' insurance coverage'